What are tax transcripts?

Short Answer:

Tax transcripts are official documents provided by the Internal Revenue Service (IRS) that summarize information provided to them about you. They are often used for various financial and legal purposes, including verifying income, applying for loans, and resolving tax issues. In addition, tax transcripts are an alternative to providing your tax returns, W2s, 1099s, etc.

Longer Answers:

When applying for a mortgage, lenders frequently ask borrower's permission to obtain tax transcripts from the Internal Revenue Service (IRS). Why? It's a way to verify the accuracy of the income documentation that you provided with your mortgage application. Here’s a comprehensive guide to understanding tax transcripts, their importance, and how to obtain them

Types of Tax Transcripts

The IRS offers several types of tax transcripts, each serving a unique purpose:

- Tax Return Transcript:

- Summarizes most line items from your original tax return (Forms 1040, 1040A, or 1040EZ) as filed, including any accompanying forms and schedules.

- Does not reflect changes made after the original filing.

- Available for the current tax year and the past 3 years.

- Tax Account Transcript:

- Provides basic information such as return type, marital status, adjusted gross income, taxable income, and payment types.

- Reflects changes made after the original filing.

- Available for the current tax year and up to 10 prior years.

- Record of Account Transcript:

- Combines details from both the Tax Return Transcript and the Tax Account Transcript.

- Available for the current tax year and the past three years.

- Wage and Income Transcript:

- Contains data from information returns like Forms W-2, 1099, 1098, and Form 5498.

- Available for up to 10 prior years.

- Verification of Non-filing Letter:

- Confirms that the IRS has no record of a filed Form 1040, 1040A, or 1040EZ for the requested year.

- Available after June 15 for the current tax year and for the past three years.

- Ordered for those who are exempt from paying US Income Taxes like G4 Visa employees

Which document is ordered by your mortgage lender will depend upon your individual situation. For many W2 (salaired) borrowers, mortgage lenders will only order the Wage and Income Transcript to verify past income history. Since this document combines information from third parties (ie employers, banks etc), the information is considered secure. For self-employed borrowers and those applying for jumbo mortgages, a Record of Account Transcript which combines the Tax Record and Account transcripts, may be required to verify all income reported to the IRS.

Why Are Tax Transcripts Important in the Mortgage Process?

Tax transcripts play a crucial role in various scenarios:

- Verify Income: A way to verify income documents provided by borrowers by a third party (IRS). In addition, the transcripts can verify that no amended tax returns have been filed showing different information.

- No Taxes Owed: Transcripts can show to a lender that a borrower does not have a deliquent tax bill owed to the IRS. Deluquient taxes can result in a lien being placed on the house in the future.

- Identity Verification: Tax transcripts help verify a borrower's identity compared to the credit report

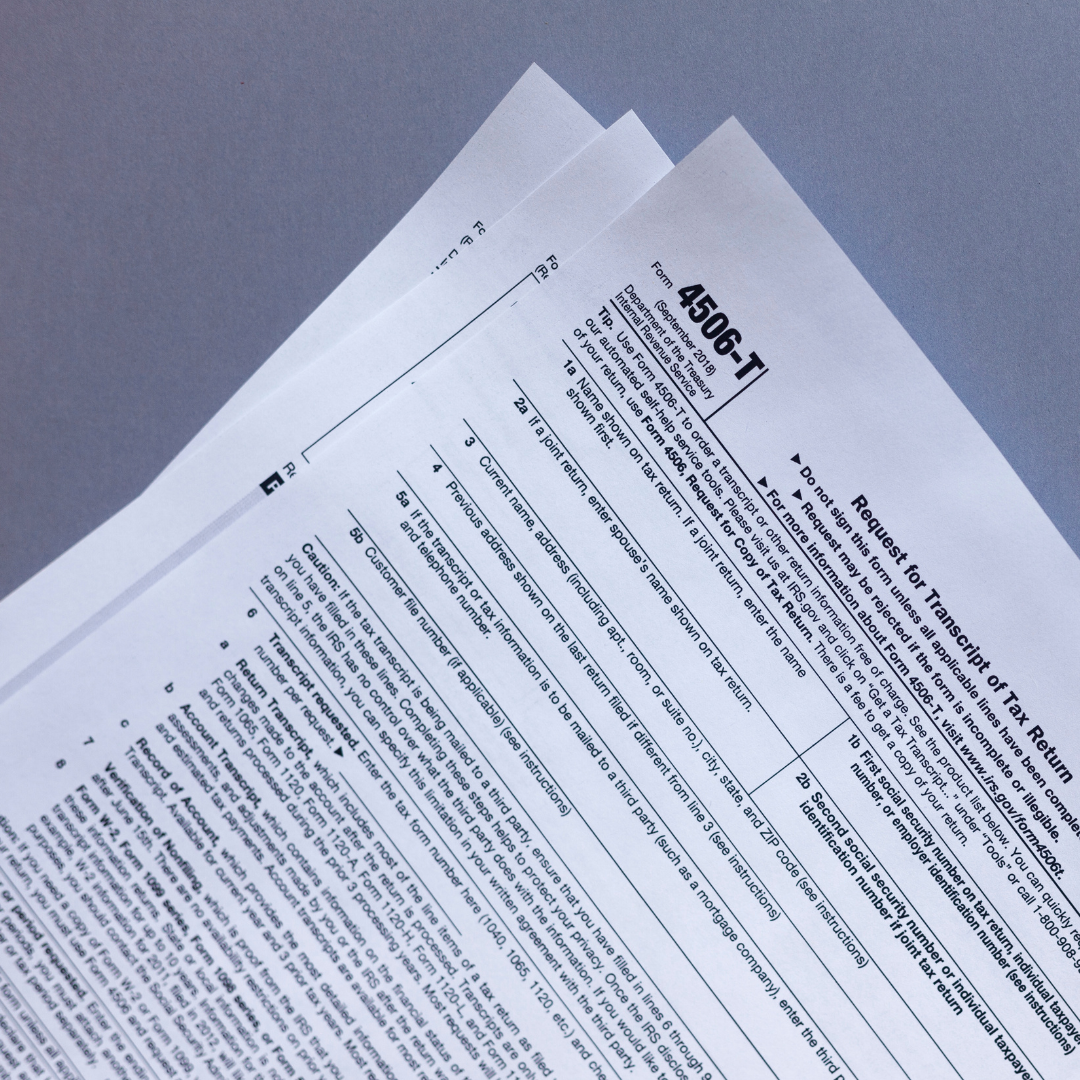

What is the 4506-T document?

Form 4506-T, or "Request for Transcript of Tax Return," is a document used to request various types of tax transcripts from the Internal Revenue Service (IRS). The 4506-T needs to have the following information on it for the IRS to return the transcripts:

- The borrower(s)' name

- The borrower(s)' address on their last tax return

- Their social security numbers(s)

- What type of transcripts you are requesting

- The years of transcripts you are requesting

- Applicant(s) signatures

Why is my lender not able to obtain my transcripts?

There are several reasons why a lender might not be able to obtain these transcripts. Many times they can be resolved by providing a copy of your last filed tax return to your lender to match information exactly.

- Errors in Personal Information: If the borrower's name, Social Security Number (SSN), or address is incorrect or does not match IRS records, the request may be rejected. Frequently, the 4506T is rejected due to a slight difference in the address like saying "apt 305" vs "Apt No 305"

- Incomplete Form: Missing information or unchecked boxes on Form 4506-T can lead to processing delays or rejection.

- Mismatched Records: If the information provided does not match IRS records, the IRS may not release the transcripts.

- Fraud Prevention: If you have notified that IRS that you are vicitim of idenity theft, they will not release tax transcripts to third party and will require you to call to request them.

- Unresolved Tax Debts: If the borrower has unresolved tax debts or issues, the IRS may withhold transcripts until these matters are resolved.

- Recent Filing: If the borrower has recently filed their tax return, it may not yet be processed and available for transcript requests. It typically takes a few weeks after filing for the information to be accessible.

How can I obtain tax transcripts?

Individuals can obtain their tax transcripts a few ways:

Online:

Visit the IRS website and use the “Get Transcript Online” tool. You will need to verify your identity by providing personal information and answering security questions.

Alternatively, use the “Get Transcript by Mail” option to receive a transcript within 5-10 days.

By Phone:

- Call the IRS and follow the prompts to request a transcript.

- By Mail:

- Complete and mail Form 4506-T, “Request for Transcript of Tax Return,” to the address listed on the form.

Conclusion

Tax transcripts are vital documents that provide a summary of your tax information reported to the IRS. Mortgage lenders use this information to verify the income documentation that you provided with your application. The type of transcripts they obtain will depend upon the type of income you earn, what type of mortgage you are applying for and the mortgage lender. Understanding the different types of transcripts and how to obtain them can help you manage your financial and tax-related needs more effectively.

—

These blogs are for informational purposes only. Make sure you understand the features associated with the loan program you choose, and that it meets your unique financial needs. Subject to Debt-to-Income and Underwriting requirements. This is not a credit decision or a commitment to lend. Eligibility is subject to completion of an application and verification of home ownership, occupancy, title, income, employment, credit, home value, collateral, and underwriting requirements. Not all programs are available in all areas. Offers may vary and are subject to change at any time without notice. Should you have any questions about the information provided, please contact me.